Financial consulting for entrepreneurs is a vital resource that guides new business owners through the complexities of managing their finances effectively. In today’s competitive market, understanding the nuances of financial management can be the difference between thriving and merely surviving. By tapping into expert advice, entrepreneurs can streamline their cash flow, develop sound forecasting techniques, and create budgets that support sustainable growth.

This journey begins with grasping the fundamentals of financial consulting, which encompass essential aspects like cash flow management, financial forecasting, and budgeting. These elements are crucial for laying a solid foundation that supports entrepreneurial ambitions and paves the way for future success.

Financial Consulting Fundamentals

Financial consulting plays a critical role for entrepreneurs, guiding them through the complex landscape of managing finances in their ventures. It encompasses an array of services tailored to meet the unique needs of startups, helping them not only to survive but to thrive in competitive markets. Effective financial consulting assists entrepreneurs in making informed decisions that can set the trajectory for long-term success.The importance of cash flow management cannot be overstated in the context of startup success.

Cash flow refers to the movement of money in and out of a business, and managing it wisely is crucial for sustaining operations. Many startups fail due to poor cash flow management, which can lead to an inability to meet obligations like payroll and supplier payments. By establishing a solid cash flow management strategy, entrepreneurs can ensure they have the liquidity needed to navigate unforeseen challenges and seize opportunities.

Cash Flow Management in Startup Success

A comprehensive cash flow management strategy is vital for maintaining operational stability in a startup. Understanding the timing of cash inflows and outflows enables entrepreneurs to plan effectively for their financial future. Key considerations include:

- Tracking Receivables: Monitoring customer payments helps predict cash inflows, allowing businesses to plan expenses accordingly.

- Managing Payables: Timing payments to suppliers can provide flexibility in cash flow management, ensuring that funds are available for essential expenses.

- Emergency Fund Establishment: Creating a buffer of cash reserves allows startups to handle unexpected costs without disrupting operations.

- Regular Cash Flow Forecasting: Frequent assessments of cash flow projections help identify potential shortfalls before they occur, enabling proactive measures.

A well-managed cash flow provides the foundation for a thriving business, allowing entrepreneurs to invest in growth opportunities and mitigate risks effectively.

Financial Forecasting and Budgeting for New Businesses

Financial forecasting and budgeting are essential components of a sound financial strategy for new businesses. These processes involve predicting future financial performance based on historical data and anticipated market conditions. Proper forecasting allows entrepreneurs to make informed decisions about resource allocation and growth strategies. Important aspects include:

- Sales Forecasting: Estimating future sales based on market research and historical data enables businesses to set realistic revenue targets.

- Expense Budgeting: A detailed budget helps identify necessary expenses and prioritize spending, which is crucial for maintaining a positive cash flow.

- Scenario Analysis: Evaluating different financial scenarios allows entrepreneurs to prepare for various potential outcomes, enhancing their strategic planning efforts.

- Performance Metrics: Establishing key performance indicators (KPIs) enables businesses to track their financial health and make adjustments as needed.

By utilizing financial forecasting and budgeting, new businesses can create a roadmap for achieving their objectives, ensuring they remain agile in the face of market changes.

“Effective financial consulting transforms uncertainties into actionable insights, setting the groundwork for sustained business success.”

Business Strategy Development

Creating a solid business strategy is essential for entrepreneurs aiming to establish a successful venture. A well-defined strategy serves as a roadmap that guides business decisions and helps in navigating the competitive landscape. This section delves into the critical components involved in developing a robust business strategy tailored to the unique needs of entrepreneurs.

Comprehensive Business Plan Creation

A comprehensive business plan is crucial for any entrepreneur, serving not only as a blueprint for the business but also as an essential tool for securing funding and guiding operations. Key elements to include in a business plan are:

- Executive Summary: A snapshot of the business, including its mission, vision, and an overview of what makes it unique.

- Market Analysis: Research on industry trends, target market demographics, and competitors that can affect the business.

- Organization and Management: An Artikel of the business structure, detailing ownership, management team, and staffing requirements.

- Products or Services: A description of the products or services offered, their competitive advantages, and pricing strategy.

- Marketing Strategy: Strategies for promoting the business, including branding, sales tactics, and distribution channels.

- Financial Projections: Forecasts of revenue, expenses, and profitability over the next few years, often incorporating break-even analysis.

- Funding Requirements: If seeking financing, a clear explanation of how much money is needed and how it will be used.

This structured approach not only helps in clarifying the vision of the business but also aids in identifying potential pitfalls and opportunities.

Identifying Competitive Advantages

Understanding competitive advantages is vital for differentiating a business from its competitors. Entrepreneurs can gain an edge in the marketplace by employing several methods, such as:

- Unique Selling Proposition (USP): Clearly define what sets your products or services apart from competitors. This could be superior quality, innovative features, or exceptional customer service.

- Cost Leadership: Focus on becoming the low-cost producer in your industry, allowing for price competition without sacrificing margins.

- Differentiation: Develop a distinct brand identity or unique offerings that appeal to specific customer segments. This could include personalized services or eco-friendly products.

- Customer Relationship Management: Establish strong relationships with customers through loyalty programs, feedback mechanisms, and personalized marketing efforts.

By thoroughly analyzing these areas, entrepreneurs can pinpoint their strengths and capitalize on them, thus creating a sustainable competitive advantage.

Designing Effective Growth Strategies

For small businesses, developing effective growth strategies is essential for long-term success. Entrepreneurs can consider the following steps:

- Market Penetration: Focus on increasing sales of existing products within the current market through tactics like promotions or improved customer service.

- Market Development: Expand into new markets, either geographically or by targeting different demographics, to attract new customers.

- Product Development: Innovate new products or enhance existing ones to meet customer needs, thereby increasing the product range.

- Partnerships and Alliances: Form strategic partnerships or alliances with other businesses to leverage complementary strengths and expand market reach.

- Acquisitions: Consider acquiring other businesses to increase market share and diversify product offerings.

Each of these strategies requires careful planning and execution, ensuring that the business adapts to market changes while maintaining a clear focus on its core competencies.

Branding and Marketing for Entrepreneurs

Creating a strong brand and effective marketing strategy is essential for entrepreneurs looking to differentiate themselves in the competitive business landscape. A well-defined brand not only communicates your values and mission but also builds trust with your audience. By focusing on branding and marketing, entrepreneurs can create a lasting impression that drives customer loyalty and business growth.Branding is the foundation of any successful business.

It encompasses the visual identity, messaging, and overall perception that customers have about your company. An effective brand helps establish recognition in the market and can significantly influence purchasing decisions. Entrepreneurs should invest time in developing a clear brand strategy that reflects their vision and resonates with their target audience. Consistency across all platforms is key, as it reinforces the brand’s reliability and professionalism.

Significance of Branding in Business Creation and Development

Branding is crucial for the creation and development of a business as it shapes the customer experience and influences market positioning. A strong brand can create emotional connections with customers, making them more likely to choose your products or services over competitors. The following points highlight the importance of branding:

-

A strong brand identity fosters customer loyalty, making it easier to retain existing customers and attract new ones.

- It differentiates your business from competitors, establishing a unique value proposition that addresses customer needs.

- Effective branding communicates professionalism and reliability, which enhances credibility in the marketplace.

- A well-defined brand can facilitate easier marketing efforts, as it provides a clear message and identity to promote.

- Branding contributes to customer perception, influencing how they view product quality, price, and overall value.

Strategies for Effective Advertising Tailored to Small Business Needs

Advertising is an essential component of marketing, especially for small businesses that need to maximize limited resources. Entrepreneurs can adopt various strategies that align with their unique circumstances. Here are some effective advertising strategies:

- Utilize social media platforms like Facebook and Instagram to create targeted ads that reach specific demographics based on interest and behaviors.

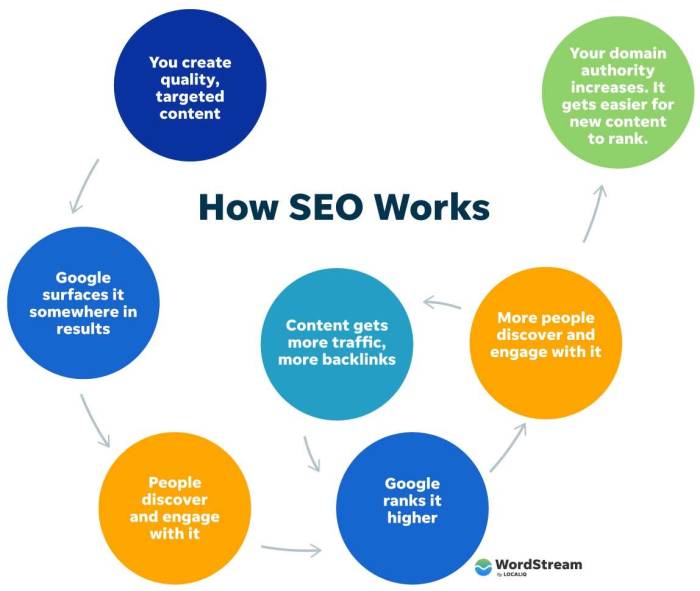

- Leverage local techniques to ensure your business appears in searches relevant to your geographical area, driving foot traffic and online visibility.

- Engage in content marketing by producing valuable content that addresses customer pain points, establishing your brand as an authority in your industry.

- Collaborate with other local businesses for cross-promotional opportunities, allowing both parties to expand their reach without significant costs.

- Utilize email marketing to maintain relationships with customers by providing updates, special offers, and personalized content that keeps your brand top-of-mind.

Leveraging Online Platforms for Business Marketing and Management

Online platforms present numerous opportunities for entrepreneurs to market their businesses effectively. By harnessing these digital tools, entrepreneurs can streamline their marketing efforts and enhance engagement with their audiences. The following strategies can be implemented:

- Build a professional website that serves as the central hub for your brand, showcasing your products, services, and story while ensuring it is optimized for search engines.

- Utilize social media management tools to schedule and analyze posts across platforms, making it easier to maintain an active online presence.

- Engage with customers through online communities, responding to inquiries and feedback promptly to foster a sense of connection and loyalty.

- Implement digital advertising campaigns using platforms like Google Ads to target potential customers actively searching for relevant products or services.

- Use analytics tools to measure the effectiveness of marketing efforts, allowing for data-driven decisions that enhance future campaigns.

Closing Notes

In conclusion, financial consulting for entrepreneurs not only equips business owners with the tools they need to navigate the fiscal landscape but also serves as a strategic partner in their journey towards growth and sustainability. By leveraging professional insights and effective financial strategies, entrepreneurs can focus on their core mission while ensuring their financial health is robust and resilient. As they embark on this journey, understanding and utilizing these consulting services can significantly enhance their chances of achieving long-term success.

General Inquiries

What is financial consulting for entrepreneurs?

Financial consulting for entrepreneurs involves expert guidance to help new business owners manage their finances, including cash flow management and budgeting.

Why is cash flow management important?

Cash flow management is crucial because it ensures that a business can meet its obligations and invest in growth opportunities, preventing financial distress.

How can financial forecasting aid my startup?

Financial forecasting allows entrepreneurs to anticipate future revenue and expenses, enabling them to make informed decisions and plan strategically.

What role does branding play in financial success?

Branding impacts customer perception and loyalty, which can lead to increased sales and revenue, directly affecting a company’s financial health.

How can entrepreneurs effectively market their business?

Entrepreneurs can market their business effectively by leveraging online platforms, using targeted advertising strategies, and creating a strong brand presence.