Kicking off with Legal steps to create a business, it’s essential to understand the groundwork needed to set your entrepreneurial journey in motion. Navigating the legal landscape can be daunting, but with the right information, you can effectively position your business for success from the very start.

This guide illuminates the key steps for registering your business, choosing the right structure, and obtaining necessary licenses. By grasping these legal essentials, you can not only ensure compliance but also lay a solid foundation for growth and stability in your new venture.

Legal Framework for Business Creation

Starting a business involves navigating a complex legal landscape that can seem daunting. However, understanding the necessary steps and legal requirements simplifies the process. This guide Artikels essential aspects of registering your business, exploring various structures, and obtaining the necessary licenses and permits.

Steps to Register a Business Legally

Registering your business legally is a critical step that protects your brand and establishes its legitimacy. Here’s a step-by-step breakdown of the registration process:

1. Choose a Business Name

Ensure the name is unique and complies with state regulations.

2. Decide on a Business Structure

Your choice (LLC, Corporation, or Sole Proprietorship) impacts taxes, liability, and operations.

3. File the Necessary Documents

Depending on your structure, you’ll need to file Articles of Incorporation, Articles of Organization, or a DBA (Doing Business As).

4. Obtain an Employer Identification Number (EIN)

This is necessary for tax purposes and can be acquired through the IRS.

5. Register for State and Local Taxes

Depending on your business location and activities, you may need various tax registrations.

6. Open a Business Bank Account

Keeping personal and business finances separate is crucial for legal protection and financial clarity.

Business Structures and Their Legal Implications

Selecting the right business structure is vital as it determines your legal obligations and risks. The three main structures are:

Limited Liability Company (LLC)

Combines the flexibility of a partnership with the liability protection of a corporation. Owners are not personally liable for business debts.

Corporation

A more complex structure that protects owners from personal liability. It requires rigorous record-keeping and has the ability to raise funds through stock sales.

Sole Proprietorship

The simplest structure, where the owner is personally responsible for all debts and liabilities of the business. This means personal assets may be at risk, but it offers complete control to the owner.

Obtaining Licenses and Permits

Depending on your industry and location, various licenses and permits may be required to operate legally. Understanding these requirements helps ensure compliance and avoids potential fines. The necessity of licenses varies widely, and here are the typical categories:

Federal Licenses

Required for businesses involved in activities regulated by federal agencies, such as selling alcohol or firearms.

State Licenses

These may include professional licenses (e.g., for doctors or teachers) and business-specific permits (e.g., for construction).

Local Permits

Municipalities often require permits related to zoning, health, and safety regulations.

Industry-Specific Licenses

For activities such as food service, child care, or transportation, special permits may be necessary.Each form of license or permit has its application process and renewal timelines. It’s crucial to research local regulations thoroughly to ensure compliance.

“Understanding the legal framework is crucial for the success and longevity of your business.”

Branding and Marketing Essentials

Establishing a strong brand identity and effective marketing strategies is crucial for the success of any new business. This involves not only creating a memorable name and logo but also understanding your audience and how to communicate with them effectively. Building a cohesive brand presence enables businesses to stand out in a competitive marketplace and fosters customer loyalty.Creating a brand identity involves several key components, including your business name, logo design, and overall visual style.

Strong branding should resonate with your target audience while reflecting your business values and mission. A well-defined brand identity can significantly influence customer perception and decision-making.

Developing a Brand Identity

A well-crafted brand identity is essential for differentiating your business from competitors. This identity serves as the foundation for all marketing efforts. The following elements are crucial in developing a unique and appealing brand identity:

- Logo Design: Your logo is the visual representation of your brand. Aim for a design that is simple, memorable, and versatile. Consider colors, shapes, and typography that convey your brand’s personality.

- Brand Colors: Choose a color palette that reflects your brand’s message and appeals to your target audience. Colors can evoke emotions and influence perceptions.

- Tagline: A catchy tagline can succinctly communicate your brand’s essence. It should be memorable and encapsulate your brand’s values.

- Brand Voice: Establish a consistent tone and style for your communications. Whether casual or formal, your brand voice should align with your identity and resonate with your audience.

- Visual Elements: Develop a consistent style for imagery, graphics, and layouts. This consistency helps create a recognizable brand across all platforms.

Strategies for Effective Business Advertising

To effectively promote your brand, it’s essential to have a strategic advertising plan that utilizes various platforms. Each advertising channel can offer unique advantages and target different demographics.Consider the following strategies for effective advertising:

- Social Media Advertising: Platforms like Facebook, Instagram, and LinkedIn allow for targeted advertising based on user demographics, interests, and behaviors. Create engaging ads that encourage interaction.

- Search Engine Marketing (SEM): Invest in pay-per-click (PPC) campaigns using Google Ads to increase visibility for specific s. This can drive traffic to your website from users actively searching for your products or services.

- Content Marketing: Develop valuable content such as blogs, infographics, or videos that educate your audience. This establishes your brand as a thought leader and builds trust with potential customers.

- Email Marketing: Utilize email campaigns to nurture leads and maintain relationships with existing customers. Personalization and segmentation are key to effective email strategies.

- Influencer Partnerships: Collaborate with influencers relevant to your industry. Their endorsement can amplify your reach and build credibility among their followers.

Building a Recognizable Online Presence

In today’s digital age, establishing a strong online presence is vital for business success. An engaging online presence helps build brand awareness and fosters customer engagement.To enhance your online visibility, focus on the following methods:

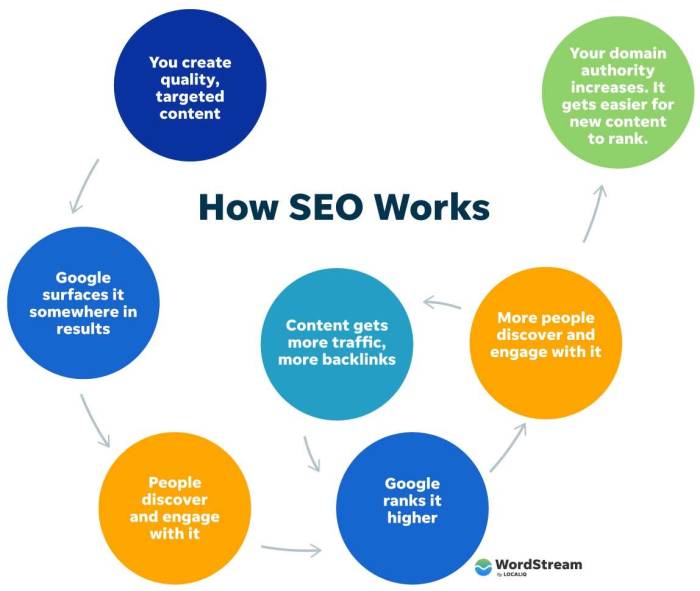

- Website Optimization: Your website should be user-friendly, mobile-responsive, and optimized for search engines (). A well-structured site improves user experience and boosts search rankings.

- Social Media Engagement: Regularly post content and interact with your audience on social media platforms. Use polls, Q&A sessions, and live videos to encourage engagement.

- Online Reviews and Testimonials: Encourage satisfied customers to leave positive reviews. Respond to reviews, both positive and negative, to show that you value customer feedback.

- Consistent Branding: Maintain consistency across all your online platforms, including your website, social media, and email campaigns. This reinforces brand recognition and trust.

- Analytics Tracking: Use tools like Google Analytics to monitor website traffic and user behavior. This data helps refine your marketing strategies and understand customer preferences.

“Branding is what people say about you. Marketing is what you say about yourself.”

Financial Management for Startups

Effective financial management is pivotal for startups aiming to achieve sustainability and growth in a competitive environment. The handling of finances not only influences the ability to survive the initial stages but also sets the groundwork for future expansion. Understanding key accounting practices, exploring funding options, and establishing a robust financial plan are essential components of managing a startup’s money successfully.

Key Accounting Practices for Startups

Implementing sound accounting practices is crucial for maintaining financial health. Startups should adopt the following practices to ensure transparency and accuracy in their financial reporting:

- Bookkeeping: Regularly recording all financial transactions helps in tracking income and expenses, which is vital for monitoring cash flow.

- Financial Statements: Preparing balance sheets, income statements, and cash flow statements provides insights into the company’s financial position and performance.

- Tax Compliance: Understanding tax regulations and keeping precise records facilitates timely filings and avoids penalties.

- Budgeting: Creating a budget allows startups to allocate resources effectively and plan for future expenses.

- Financial Audits: Conducting periodic audits can identify discrepancies, enhance accountability, and provide reassurance to stakeholders.

Funding Options for Startups

Identifying appropriate funding sources is integral to a startup’s financial strategy. Various funding options can facilitate the launch and growth of a business:

- Personal Savings: Using personal funds can provide a solid foundation for initial business expenses without incurring debt.

- Angel Investors: These individuals often provide capital in exchange for equity, bringing both funding and valuable mentorship.

- Venture Capital: For startups with high growth potential, attracting venture capital firms can lead to significant investments in exchange for equity stakes.

- Crowdfunding: Platforms like Kickstarter or Indiegogo allow entrepreneurs to raise funds by promoting their ideas directly to the public.

- Small Business Loans: Traditional banks and credit unions offer loans with specific terms that need to be met, thus requiring a solid business plan and creditworthiness.

Creating a Financial Plan

A well-structured financial plan is essential for guiding a startup’s financial decisions and ensuring long-term success. This plan should encompass both budgeting and forecasting to manage resources effectively.

- Budgeting: Startups should Artikel expected revenues and expenses, thereby creating a financial roadmap. This budget should be revisited and adjusted regularly based on actual performance.

- Financial Forecasting: Estimating future revenues and expenses helps in planning for growth. Using historical data, market research, and economic trends can enhance the accuracy of these forecasts.

- Cash Flow Management: Monitoring cash flow ensures that the business can meet its financial obligations, pay employees, and invest in growth opportunities.

- Profit Margin Analysis: Regularly analyzing profit margins helps startups determine pricing strategies and cost control measures.

- Break-even Analysis: Understanding the break-even point allows businesses to set sales targets and evaluate the feasibility of new initiatives.

“Financial management is not just about numbers; it’s about making strategic decisions that drive growth and sustainability.”

Outcome Summary

In conclusion, understanding the legal steps to create a business is crucial for any aspiring entrepreneur. By carefully considering your business structure and ensuring all necessary registrations and permits are in place, you set the stage for a successful and sustainable enterprise. Embrace these steps with confidence, and let your business aspirations take flight!

FAQ Compilation

What is the first step in starting a business?

The first step is to choose a business idea and conduct market research to validate your concept.

How do I choose the right business structure?

Consider factors like liability, taxes, and management when deciding between options like LLC, Corporation, or Sole Proprietorship.

What types of licenses might I need?

Licenses vary by industry and location; common types include business licenses, health permits, and zoning permits.

How can I finance my startup?

You can explore options such as personal savings, loans, investors, or crowdfunding to finance your startup.

What role does branding play in a new business?

Branding is crucial as it helps establish your business identity and can significantly influence customer perception and loyalty.